2024 Employee Business Expenses Tax Credit

2024 Employee Business Expenses Tax Credit – Taxpayers who filed for the ERC may face a March 22nd Deadline on applying for the IRS Voluntary Disclosure Program. Taxpayers need to ensure they qualify for the ERC. . The Internal Revenue Service offers federal tax incentives to encourage businesses to hire new employees 535, Business Expenses, provides detailed information about the tax credits. .

2024 Employee Business Expenses Tax Credit

Source : www.freshbooks.com2024 State Business Tax Climate Index | Tax Foundation

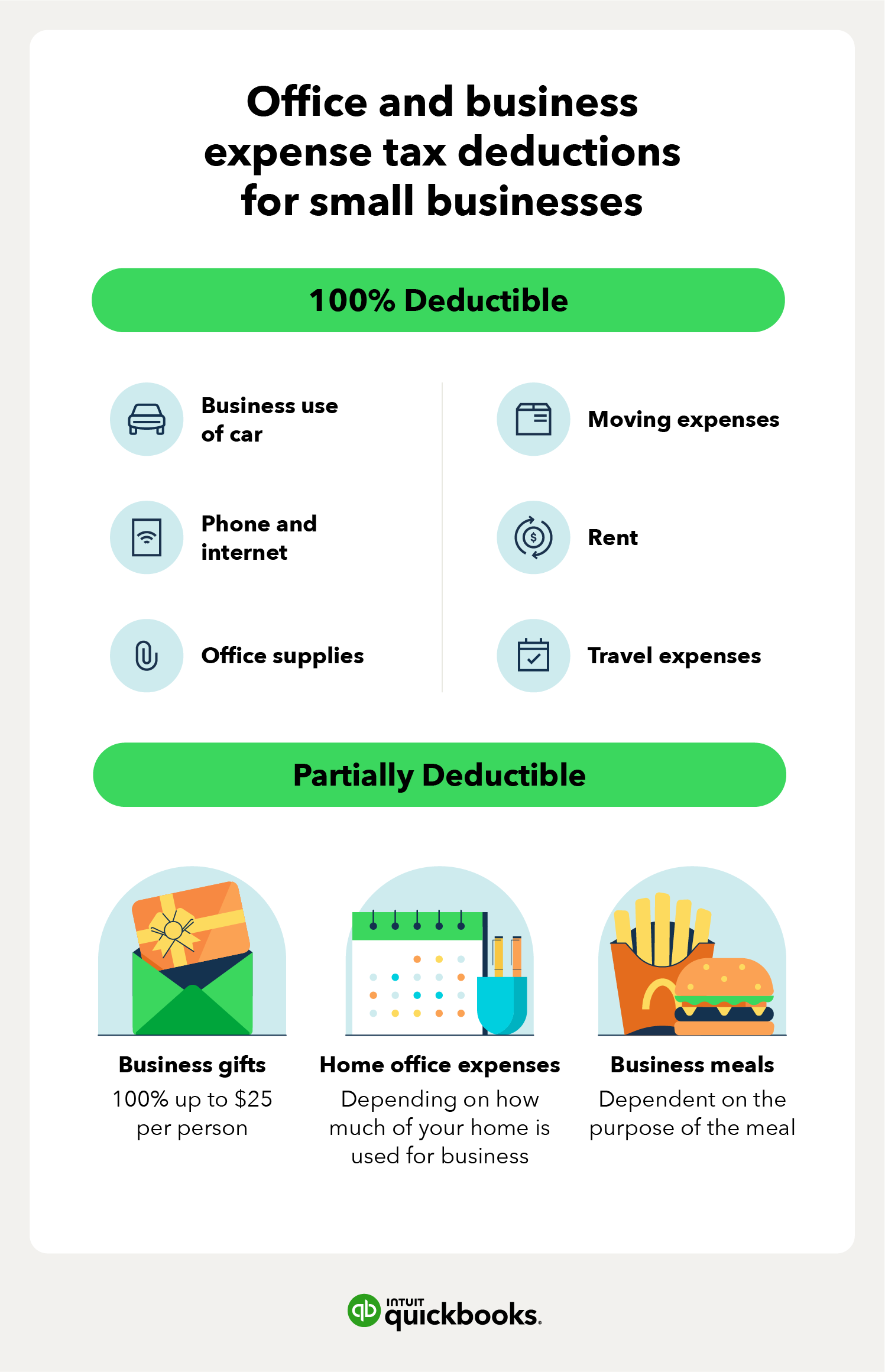

Source : taxfoundation.orgSmall Business Expenses & Tax Deductions (2023) | QuickBooks

Source : quickbooks.intuit.comWhat to Expect from the Tax Relief for American Families and

Source : www.mgocpa.comSmall Business Expenses & Tax Deductions (2023) | QuickBooks

Source : quickbooks.intuit.com19 Tax Deductions for Independent Contractors in 2024

Source : www.deel.com2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.orgIRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.comThe Best Business Mileage Tracker Apps for 2024

Source : www.fylehq.com2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.org2024 Employee Business Expenses Tax Credit 25 Small Business Tax Deductions To Know in 2024: Many small-business owners are missing out on offering retirement plans to their employees because they’re unfamiliar with tax credits that could help lower or foreclosure and to help pay for . Bankrate says the average person has a credit card limit between $2,000 and $10,000. If your employee charges $6,506 in business expenses and $2,347 in personal expenses on their personal card .

]]>